ITIN Application

What is an ITIN ?

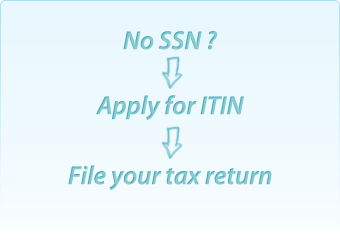

An Individual Taxpayer Identification Number (ITIN) is a 9 digit tax processing number issued by the Internal Revenue Service (IRS) for individuals who are required to have a U.S. taxpayer identification number but do not have, and are not eligible to obtain a Social Security Number (SSN).

TINs are issued regardless of immigration status because both resident and nonresident aliens may have a U.S. filing or reporting requirement .

Individuals must have a filing requirement and file a valid federal income tax return to receive an ITIN, unless they meet an exception.

What is an ITIN used for?

ITINs are for federal tax reporting only, and are not intended to serve any other purpose. IRS issues ITINs to help individuals comply with the U.S. tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security Numbers (SSNs).

An ITIN does not authorize work in the U.S. or provide eligibility for Social Security benefits or the Earned Income Tax Credit.

Who needs an ITIN?

IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for SSNs. A non-resident alien individual not eligible for a SSN who is required to file a U.S. tax return only to claim a refund of tax under the provisions of a U.S. tax treaty needs an ITIN.

Other examples of individuals who need ITINs include:

- A nonresident alien required to file a U.S. tax return

- A U.S. resident alien (based on days present in the United States) filing a U.S. tax return

- A dependent or spouse of a U.S. citizen/resident alien

- A dependent or spouse of a nonresident alien visa holder

Our services

We prepare W-7 forms for each applicant and guide you how to apply for ITIN: We also provide Certifying Acceptance Agent Services for ITIN application.

Certifying Acceptance Agent Advantages

Any application for an ITIN must submit certain specified ORIGINAL or U.S. based notarized identification proving identity and alien status, before an ITIN is issued. Normally, this original identification must be sent to any office of the Internal Revenue Service ITIN Unit.

When you apply with a Certifying Acceptence Agent , rather than sending ORIGINAL identification documents to an IRS Office, you may provide that information to the agent, and we can expedite the issuance of an ITIN. We can also apply for an ITIN on your behalf, upon receipt of a Power of Attorney from you.