The United States has provided about $1.9 trillion that was approved and signed into law under the American Rescue Plan (ARP) Act. Most of the provisions are temporary expansions for 2021 to fight the pandemic. However, some policymakers are already considering making some of the changes permanent.

Below we provide more details on tax-related benefits in the American Rescue Plan Act of 2021. Here is the final version of the tax provisions:

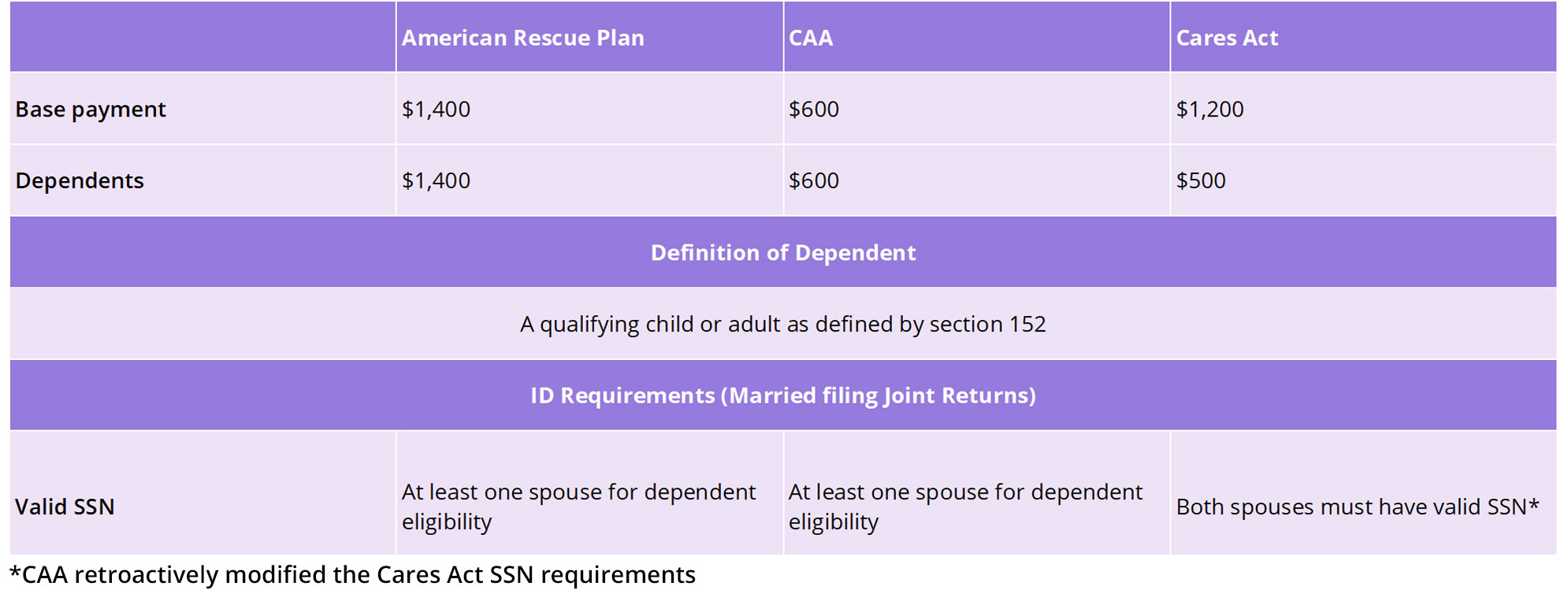

$1,400 stimulus payments (economic impact payments)

The new stimulus package provides recovery rebate credit for individuals up to $1,400 per adult ($2,800 for married couples filing jointly) plus additional $1,400 for each dependent as defined in Sec. 152.

- For single taxpayers; payment will begin to phase out at an adjusted gross income (AGI) of $75,000, and will be completely phased out for single taxpayers with an AGI over $80,000.

- For married taxpayers who file jointly; the phaseout will begin at an AGI of $150,000 and end at AGI of $160,000.

- For head of households; the phaseout will begin at an AGI of $112,500 and be complete at AGI of $120,000.

If taxpayer did not file 2020 return, the act uses 2019 AGI to determine eligibility.

Table 1. Eligibility Comparison of Economic Impact Payments

Tax free unemployment benefits

First $10,200 in unemployment benefits tax-free in 2020 for taxpayers making less than $150,000 per year. This change is retroactive and effects 2020 returns.

Refundable child tax credits

The new package increased the amount of the credit to $3,000 per child (or $3,600 for children under age of 6). The increased credit amount phases out for taxpayers with incomes over $150,000 for taxpayers filing married filing jointly, $112,500 for heads of household, and $75,000 for others, reducing the expanded portion of the credit by $50 for each $1,000 of income over those limits.

The IRS will send advanced monthly payments in one-twelfth of the annual estimated amount of the child tax credit. Payments will run from July through December 2021.

Child and dependent care credit

Effective for tax year 2021 only, child and dependent care credit is refundable. The credit will be worth 50% of eligible expenses, up to a limit based on income, making the credit worth up to $4,000 for one qualifying individual and up to $8,000 for two or more. Credit reduction will start at household income levels over $125,000. For households with income over $400,000, the credit can be reduced below 20%.

Earned income tax credit

With the new change, the applicable minimum age for EITC is decreased to 19, except for students age of 24 and qualified former foster youth or homeless youth age of 18 for 2021. The maximum age is eliminated.

- The credit’s phaseout percentage is increased to 15.3%, and the phaseout amounts are increased.

- The credit would be allowed for certain separated spouses.

- The threshold for disqualifying investment income would be raised from $2,200 to $10,000.

- Temporarily, taxpayers are allowed to use their 2019 income, instead of 2021 in figuring the credit amount.

Tax free student loan forgiveness

Student loans those are forgiven between Dec. 31, 2020, and before Jan. 1, 2026 will be tax free and shouldn’t be reported in adjusted gross income.

Family and Sick Leave Credits

Fully refundable family and sick leave credits against payroll taxes to compensate employers and self-employed people for coronavirus-related paid sick leave and family and medical leave are extended to Sep 30 2021.

- The act increases the limit on the credit for paid family leave to $12,000.

- The number of days a self-employed individual can take into account in calculating the qualified family leave equivalent amount for self-employed individuals increases from 50 to 60.

- The paid leave credits will be allowed for leave that is due to a COVID-19 vaccination.

- The limitation on the overall number of days taken into account for paid sick leave will reset after March 31, 2021.

- The credits are expanded to allow 501(c)(1) governmental organizations to take them.

Employee Retention Tax Credit

The Employee Retention Tax Credit (ERTC), which was scheduled to expire on June 30, 2021, is extended till the end of December 2021. The ERTC percentage is 70 percent of up to $10,000 in qualified wages per employee per quarter (maximum $28,000 per employee for 2021).

The Employee Retention Tax Credit is also extended to new businesses started after February 15th, 2020, with average annual receipts under $1,000,000. ERTC may not exceed $50,000 per quarter for this type of businesses.

References;

IRS Statement – American Rescue Plan Act of 2021

https://www.irs.gov/newsroom/irs-statement-american-rescue-plan-act-of-2021

The American Rescue Plan Act of 2021 (H.R. 1319)

https://budget.house.gov/american-rescue-plan-act-2021-hr-1319

Disclaimer

This article is intended for informational purposes and should not be taken as legal or tax advice. You must consult with your tax, financial or legal adviser about your unique financial situation before acting on anything discussed in this article. TaxBasket LLC is providing informational content for general guidance to help small business owners become more aware of certain issues and topics and this article must never be considered as a substitute for advice provided by your tax, financial or legal advisers. TaxBasket LLC or its members cannot be held liable for any use or misuse of this content.